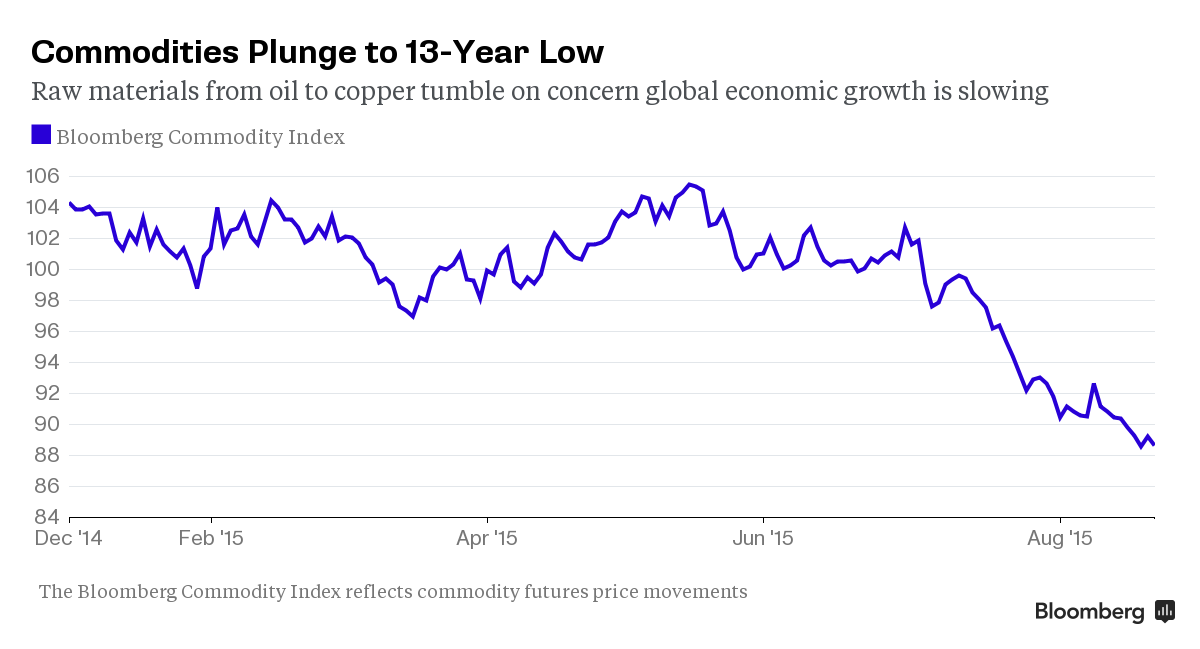

A quick look at the charts in this post show you a lot of what you need to know.

A check of this chart will show you the cause of a lot of the current downturns.

This graph is of the Bloomberg Commodity index and as you can easily see it's down a bunch just since December. The down turn of commodities across the board means big trouble for resource supplying countries, Venezuela, Brazil, Argentina, Australia, Saudi Arabia. Russia , ok just throw anybody who digs anything out of the ground and you'll have the big picture.

The slow down has been edging toward us for awhile but seems to have escalated when the deal between the Saudis and the US to lower the price of oil in an attempt to destroy Russia. It seems to have brought to the forefront all the problems that have sitting out there to get noticed. China one of the bigger dogs on the block has been loosing exports for a long time, Couple with the lack of bucks from oil sales has caused exports to drop and import to also fall.

With some EU nations on the verge of default with many more waiting in the wings this down turn would appear to not have and end is site. All raw material prices are in the tank with one exception and this exception is Gold. Gold you know that's where the rich go when the game is over. It's also a sure sign the trouble is in the wind. The stock annalists last week pointed to the death cross of the Dow averages , that's where the 50 day moving average crossed the 200 day moving average as a major indicator of a large downturn in the making. Here's the chart below.

The Death Cross last happened in 2011 and has most always signaled a down turn ahead.

What will probably make this fall worse is the positions held by a lot of Hedge Funds who have large holding of derivatives on all kinds of things including currencies,oil and interest rates in which they hold large holdings. Just one example Oil, they have purchased large lots of oil they are storing in tankers at a price the are well below today, they were betting that oil would top 50 or 60 withing in a year, it looks now that it won't happen and they will be taken to the cleaners. Their other largest holding are in interest rate swaps and national debt . Several funds have taken huge losses on these bets (notice I didn't call them an investment) and are sill liable for a lot more they may loose.

Here's a list of the countries affected just by China's slow down.

THE KA-POOM THEORY

The KA part is the deflationary trend we currently are watching where stocks and commodities had reached the stratosphere and then there is the POOM part where inflation takes off and of course followed by a new stock bubble. The theory is that to avoid the fall governments will cranks up their high speed money making machines which of course ends up causing inflation. There is I think another reason inflation will appear and an old economic saying comes to mine. Inflation is too many dollars chasing too few products. With all the bankruptcies that will happen , companies will disappear and that will take time to up production .

This could go on for many more pages but I think the above is enough to give you the idea we are deep in the shits and may have to tread water for a long long time. I would like to be able to tell you a safe haven for your money but there doesn't appear to be any safe haven in this mess.

So strap yourself in and prepare for a rough ride.

"World’s Richest People Lose $182 Billion in Market Rout" The article below the one you linked too was this article. It made my day : ) Couldn't happen to a greedier, more pompous, selfish group. Good charts on the link.

ReplyDeleteI agree we are in for a extremely bumpy ride starting right now. Can you give more detail on the hyperinflation you see coming. Corporations go under, so products are more scarce. Nobody has any money so how do they pay for over-inflated products? What a mess.

Next post on the refugees absolutely flooding over Europe's borders? I am wondering if the same thing is going to happen in the U.S. and Canada soon? Their economies are crashing too.

~Heidi